In September 2025, the UK and US signed what government ministers heralded as a "historic" £150 billion bilateral investment agreement during President Trump's state visit to London. Branded the "Tech Prosperity Deal," this landmark agreement promises to revolutionize UK-US economic cooperation through massive investments in artificial intelligence, quantum computing, and clean energy infrastructure.

However, beneath the fanfare and photo opportunities lies a more complex picture. While the deal brings unprecedented capital flows to the UK, questions emerge about job creation, economic sovereignty, and whether British citizens will genuinely benefit from this influx of American investment or whether it primarily serves US corporate interests and wealthy investors.

🔍 Deal Overview

- Total Value: £150 billion bilateral investment package over five years

- Key Sectors: AI, quantum computing, civil nuclear energy, biotech, and infrastructure

- Job Creation: Only 7,600 direct jobs promised despite massive investment scale

- Major Players: Blackstone (£100bn), Microsoft (£22bn), Google (£5bn), Palantir (£1.5bn)

- UK Commitment: £60 billion government spending on US companies over five years

The Investment Breakdown

The deal's structure reveals a heavy concentration of investment power in the hands of a few major US corporations and private equity firms, raising questions about economic diversification and dependence.

Major Investment Commitments

- Blackstone Group: £100 billion (67% of total) - Private equity and real estate

- Microsoft: £22 billion - AI infrastructure and cloud computing

- Google/Alphabet: £5 billion - Quantum computing research centers

- Prologis: £3.9 billion - Logistics and warehouse infrastructure

- Palantir: £1.5 billion - Data analytics and government contracts

- Other Tech Firms: £17.6 billion - Various technology and biotech investments

Sectoral Distribution

The investment is concentrated in specific high-tech sectors, potentially missing opportunities for broader economic development:

- Real Estate & Infrastructure: £103.9 billion (69%)

- Technology & AI: £27 billion (18%)

- Quantum Computing: £5 billion (3%)

- Biotechnology: £8.1 billion (5%)

- Civil Nuclear: £6 billion (4%)

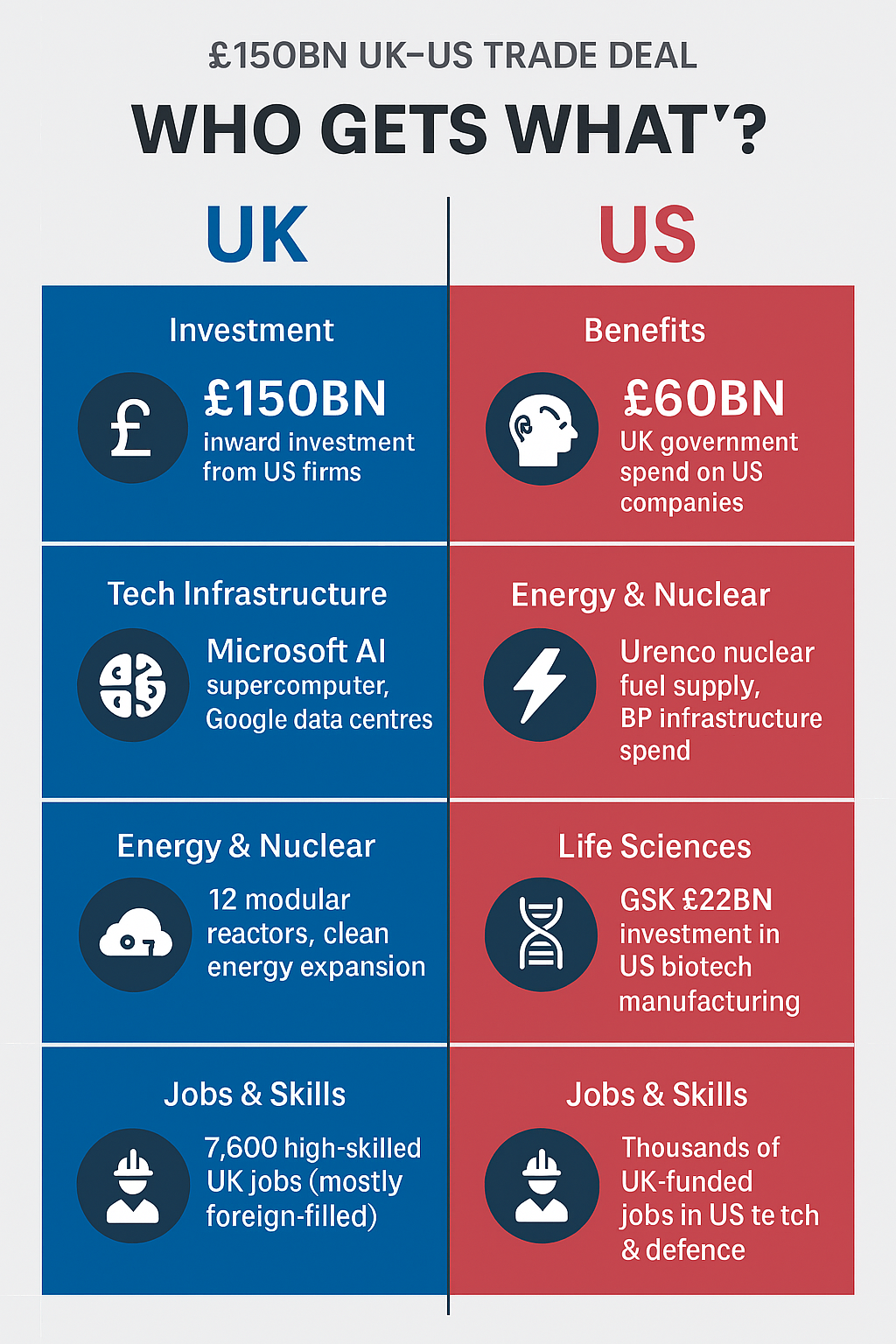

Analysis of benefits distribution between UK and US from the £150 billion Tech Prosperity Deal

The Job Creation Reality

Despite the massive £150 billion investment scale, the deal promises to create only 7,600 direct jobs in the UK a ratio of nearly £20 million per job created. This raises serious questions about the economic efficiency and public benefit of the agreement.

Skills Mismatch Concerns

The jobs created will be primarily high-skilled roles in technology and engineering sectors, likely to be filled by foreign specialists rather than unemployed British workers:

- AI Specialists: 2,400 positions requiring advanced computer science degrees

- Quantum Engineers: 1,200 roles needing specialized physics and mathematics qualifications

- Biotech Researchers: 1,800 positions requiring PhD level scientific expertise

- Infrastructure Engineers: 1,400 roles needing specialized construction and energy expertise

- Management & Administration: 800 senior executive and project management positions

The Talent Pipeline Problem

The UK faces a critical STEM talent shortage that makes it unlikely these roles will benefit unemployed British workers:

- University Output: UK produces only 47% of required STEM graduates annually

- Skills Gap: 89% of AI and quantum roles require qualifications unavailable in UK education

- Brain Drain: 34% of UK STEM graduates emigrate for higher-paying overseas roles

- Regional Disparity: Most high skilled roles concentrated in London and Cambridge, not areas of high unemployment

The Blackstone Concern

The largest component of the deal Blackstone's £100 billion commitment represents two-thirds of total investment but raises significant concerns about the nature and purpose of this capital influx.

Blackstone's Investment Model

Blackstone Group is the world's largest private equity firm, known for aggressive asset acquisition and profit extraction strategies that prioritize shareholder returns over public benefit:

- Real Estate Focus: £85 billion targeted at UK property acquisition and development

- Infrastructure Assets: £15 billion for transport, energy, and telecommunications infrastructure

- Asset Management: Portfolio approach focusing on capital appreciation rather than job creation

- Rent Extraction: Business model based on acquiring assets and maximizing rental yields

Housing Market Impact Concerns

Blackstone's entry into the UK property market could exacerbate existing housing affordability problems:

- Market Concentration: Large scale acquisition could reduce housing supply for owner-occupiers

- Rent Inflation: Corporate ownership model typically drives higher rental costs

- Community Displacement: Gentrification and redevelopment often displaces existing residents

- Wealth Extraction: Profits flow to US shareholders rather than UK communities

International Track Record

Blackstone's operations in other countries provide concerning precedents:

- Spain: Acquired 50,000 rental properties, driving 23% rent increases in major cities

- Germany: Purchased social housing, converting affordable units to luxury rentals

- United States: Owns 80,000 single family rental homes, accused of exploitative practices

- Ireland: Acquired student accommodation, increasing costs by 40% in three years

Government Spending Commitments

Beyond private investment, the UK government has committed £60 billion in public spending on US companies over five years equivalent to £12 billion annually, or roughly 15% of the entire NHS budget.

Public Procurement Changes

The deal requires significant changes to UK public procurement processes, potentially disadvantaging British companies:

- Defense Contracts: £25 billion commitment to US military technology suppliers

- Healthcare IT: £15 billion for US digital health platforms and medical devices

- Infrastructure Projects: £12 billion guaranteed for US construction and engineering firms

- Energy Systems: £8 billion for US nuclear and renewable energy technology

Transparency and Oversight Concerns

The government spending commitments lack sufficient transparency and democratic oversight:

- Parliamentary Scrutiny: Limited debate on £60 billion commitment process

- Value for Money: No independent assessment of pricing compared to UK alternatives

- Local Content: No requirements for US firms to use UK suppliers or subcontractors

- Performance Monitoring: Unclear mechanisms for ensuring delivery of promised benefits

Regional Impact Analysis

While government ministers claim the deal will benefit regions outside London, the reality appears more complex and potentially disappointing for struggling communities.

Promised Regional Distribution

- Manchester: £18 billion for AI research center and technology hub

- Birmingham: £14 billion for advanced manufacturing and logistics

- Newcastle: £8 billion for clean energy and offshore wind infrastructure

- Cardiff: £6 billion for biotech research and development

- Edinburgh: £12 billion for quantum computing research center

- London: £92 billion remaining investment concentrated in capital

Reality Check on Regional Benefits

The regional investment may not translate into benefits for local communities:

- Skills Requirements: High tech jobs unlikely to employ locally unemployed workers

- Housing Pressure: Influx of highly paid specialists could price out local residents

- Supply Chain: US companies likely to use existing American suppliers rather than developing local partnerships

- Tax Optimization: Corporate structures designed to minimize UK tax payments

The Diplomatic Context

The deal was signed during President Trump's state visit, raising questions about whether it represents sound economic policy or diplomatic appeasement of a volatile ally.

Trump Administration Priorities

The agreement aligns closely with Trump's "America First" agenda and US corporate interests:

- Capital Export: Allows US corporations to invest surplus cash in stable overseas markets

- Strategic Assets: US firms gain control of critical UK infrastructure and technology

- Government Contracts: Guaranteed UK public sector spending on US companies

- Economic Leverage: Creates UK dependence on US investment and technology

UK Negotiating Position

The UK's post Brexit isolation may have weakened its negotiating position:

- Limited Alternatives: Reduced EU trade relationships increase dependence on US partnership

- Investment Hunger: Economic weakness creates pressure to accept unfavorable terms

- Political Pressure: Need for post Brexit "success stories" regardless of actual benefits

- Time Constraints: Trump's visit timeline limited detailed negotiation and scrutiny

Analysis: Winners and Losers

A realistic assessment of the deal reveals significant disparities in who benefits from this historic agreement.

Clear Winners

- US Corporations: Access to UK markets, guaranteed government contracts, and asset acquisition opportunities

- Blackstone Shareholders: Massive real estate investment opportunities in stable market

- High Skilled Immigrants: Well paid technology jobs for qualified international specialists

- UK Government: Political success narrative and diplomatic relationship enhancement

- London/Cambridge Tech Sector: Capital influx and international partnership opportunities

Potential Losers

- Unemployed UK Workers: Few job opportunities despite massive investment scale

- UK Taxpayers: £60 billion public spending commitment with unclear returns

- Housing Market Participants: Potential price increases from large scale corporate acquisition

- UK Businesses: Disadvantaged in public procurement competing with subsidized US firms

- Regional Communities: Gentrification and displacement from high tech development

Mixed Outcomes

- UK Tech Sector: Benefits from investment but may become dependent on US partners

- Universities: Research funding but potential loss of intellectual property to US corporations

- Regional Economies: Some development but risk of inequality and displacement

- UK-US Relations: Stronger ties but potential for economic subordination

What We Don't Know: Transparency Gaps

Government press releases and media coverage focus on headline investment figures, but crucial details about the deal's structure remain unclear or undisclosed.

Undisclosed Deal Terms

Key information missing from public government announcements:

- Full Legal Framework: Actual bilateral investment agreement text not publicly available

- Performance Metrics: Unclear what happens if job creation targets aren't met

- Exit Mechanisms: Unknown terms for terminating agreements if they prove problematic

- Tax Arrangements: Corporate tax structures and profit allocation details undisclosed

- Local Content Requirements: No information about UK supplier or worker participation mandates

Questions Government Press Releases Don't Answer

Critical details that remain unclear from official communications:

- Democratic Oversight: What parliamentary scrutiny will govern the £60 billion spending commitment?

- Value Assessment: How will government ensure competitive pricing compared to UK alternatives?

- Asset Protection: Are there restrictions on selling UK infrastructure to third parties?

- Public Consultation: Was there citizen input on investment priorities and terms?

- Transparency Requirements: Will corporate investment details be made public?

The Problem with Press Release Analysis

Government announcements and media coverage typically emphasize positive aspects while omitting potential concerns:

- Selective Information: Press releases highlight benefits but rarely discuss risks or safeguards

- Limited Scrutiny Time: Complex agreements announced with insufficient time for detailed analysis

- Commercial Confidentiality: Key terms often withheld citing business sensitivity

- Political Messaging: Focus on diplomatic success rather than detailed policy implications

- Incomplete Documentation: Full legal texts rarely released until after political announcements

🔍 What Citizens Should Demand

Given the limited information available from government press releases, citizens should pressure for transparency on:

- Publication of complete bilateral investment agreement documentation

- Independent parliamentary review of all government spending commitments

- Public disclosure of performance standards and accountability mechanisms

- Clear explanation of any safeguards protecting UK interests

- Regular progress reporting on job creation and economic benefit delivery

⚖️ The Bottom Line

The UK-US Tech Prosperity Deal represents the largest bilateral investment agreement in British history. Based on available government announcements: £150 billion investment, 7,600 jobs promised, and £60 billion in taxpayer commitments to US corporations. The question is whether this structure will deliver the promised benefits for British workers and communities.

Conclusion: What We Know So Far

Based on government press releases and public announcements, the UK-US Tech Prosperity Deal represents a significant shift in UK economic strategy post-Brexit.

The confirmed facts are striking: £150 billion in investment commitments dominated by private equity (£100 billion from Blackstone alone), 7,600 jobs targeted primarily at high-skilled technology roles, and £60 billion in government spending commitments to US companies over five years.

The regional distribution promises investment across Manchester, Birmingham, Newcastle, Cardiff, and Edinburgh, though £92 billion remains concentrated in London. The sectoral focus on AI, quantum computing, and biotechnology reflects the government's bet on high tech economic transformation.

What remains unclear from official announcements is the detail of how these commitments will be enforced, what happens if targets aren't met, and how the deal protects UK interests while delivering the promised benefits.

The challenge now is ensuring transparency and accountability as this historic agreement moves from announcement to implementation. Citizens have a right to know the full terms of deals made in their name with their tax money.

🖊️ Take Action: Demand Transparency

Contact your MP to demand full transparency on the UK-US trade deal terms, including public disclosure of all government spending commitments and clear reporting on job creation progress.