Sarah's coffee shop was thriving. After eighteen months of 12-hour days and zero salary, she was finally building a customer base in Manchester's Northern Quarter. Monthly turnover had grown steadily to £7,500, and for the first time, she could see a path to profitability. Then she crossed the VAT threshold.

Within weeks, Sarah was forced to add 20% to her prices, making her coffee £3.60 instead of £3.00 while the independent across the street remained at £3.00. Customer numbers plummeted. The business that had survived the pandemic, energy crisis, and supply chain chaos was killed by the UK tax system's cliff edge design. Sarah closed three months later, joining the one in five UK businesses that fail in their first year.

💸 The Small Business Death Trap

- UK tax system creates cliff edges where liabilities spike before revenue stabilizes

- VAT threshold at £90,000 makes businesses 20% less competitive overnight

- Corporation tax, NICs, and compliance costs hit before cash flow stabilizes

- ONS data shows 20% of businesses fail in year one, 60% within five years

- Treasury prioritizes revenue extraction over business survival and growth

- Current system destroys more tax base than it creates through business failures

The Harsh Reality for Start-Ups

The UK's small business failure rate tells a story of systemic dysfunction. According to ONS business demography data, around 20% of businesses fail within their first year, with the failure rate climbing to over 60% within five years. While energy costs, rent, and supply chain pressures contribute to these failures, taxation and compliance burdens are often the decisive factors that tip struggling businesses into bankruptcy.

The Scale of Small Business Destruction

The ONS statistics reveal an economy systematically destroying entrepreneurial ambition:

- Annual Failure Rate: ONS data shows approximately 350,000 business closures each year, with many occurring in their first 18 months

- Sector Variations: Industry surveys suggest retail and hospitality face higher early failure rates than the national average

- Tax Compliance Burden: UK SMEs spend an estimated £25 billion annually on tax compliance according to accountancy sector analysis

- Overall Tax Load: CBI data shows UK businesses paid over £320 billion in taxes in 2024/25, with corporation tax and employer NICs forming nearly two-thirds

- Investment Loss: Failed businesses represent billions in destroyed personal savings and family investment

- Employment Impact: Each failed business eliminates potential jobs, with estimates suggesting 2-3 positions per closure

The Tax System Design Flaw

The UK tax system appears designed to maximize immediate Treasury receipts rather than foster business growth:

- Cliff Edge Structure: Tax liabilities jump dramatically at specific thresholds rather than graduating smoothly

- Timing Mismatch: Tax obligations arrive before businesses achieve stable cash flow

- Compliance Complexity: Administrative burdens consume limited working capital and management time

- Growth Punishment: Success triggers immediate cost increases that can exceed marginal revenue

- Competitive Disadvantage: Tax compliance costs favor established businesses over innovative startups

International Competitiveness

Other countries demonstrate that different approaches to startup taxation can foster rather than hinder entrepreneurship:

- Estonia: Zero corporate tax on retained earnings, allowing startups to reinvest profits

- Singapore: Partial tax exemption for first S$300,000 of company income

- Ireland: 12.5% corporation tax rate supporting business development

- Netherlands: Startup tax relief and reduced administrative burden for new businesses

- Germany: Simplified tax procedures and reduced rates for Existenzgründer (startup founders)

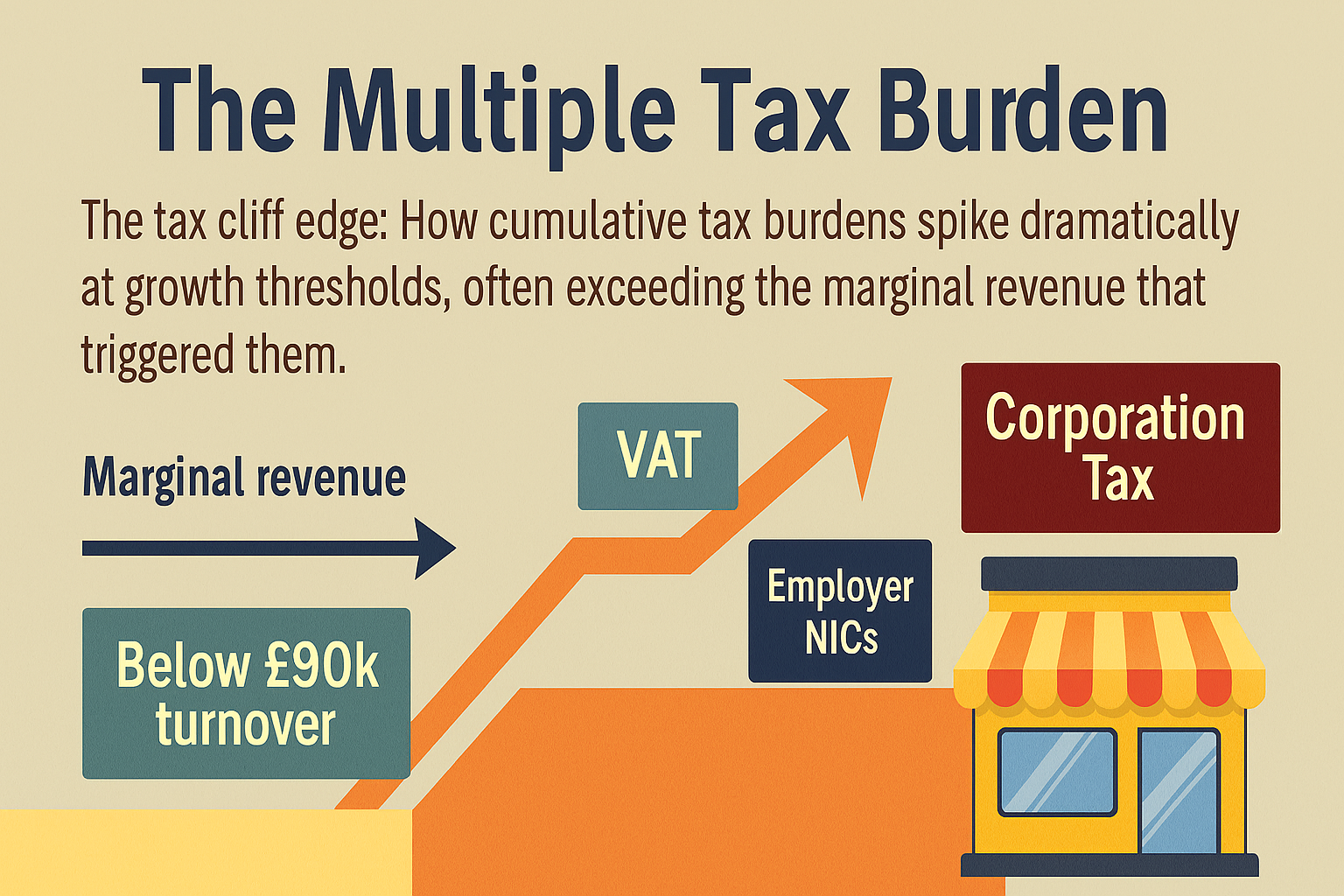

The Multiple Tax Burden

Small businesses in the UK face a complex web of tax obligations that create multiple cliff edges, each capable of destroying an otherwise viable enterprise.

Corporation Tax: The Profit Penalty

The current corporation tax structure punishes business growth and profitability:

- Small Profits Rate: 19% on profits up to £50,000 (relatively manageable for startups)

- Marginal Relief: Complex tapering between £50,000-£250,000 with effective rates reaching 26.5%

- Main Rate: 25% on profits above £250,000, among the highest in the developed world

- Timing Issues: Tax due on profits whether or not cash has been collected from customers

- Advance Payments: Required quarterly payments based on estimated profits, creating cash flow pressure

- Complex Calculations: Professional fees for compliance typically range from £1,000-5,000 annually for small businesses, depending on complexity

Employer National Insurance: The Employment Tax

NICs create a direct penalty for job creation, hitting businesses as soon as they hire their first employee:

- Standard Rate: 13.8% on all salaries above £9,100 per employee per year

- Low Threshold: Kicks in at just £175 per week, affecting even part-time minimum wage workers

- No Upper Limit: Unlike employee NICs, employer contributions continue indefinitely

- Immediate Impact: A £20,000 salary costs the employer an additional £1,500 in NICs

- Growth Deterrent: Every additional employee immediately increases costs by 13.8% of their salary

- Cash Flow Timing: Due monthly via PAYE, creating immediate working capital pressure

The VAT Cliff Edge

The most destructive element of UK business taxation is the VAT threshold cliff edge:

- Threshold Level: £90,000 annual turnover triggers mandatory VAT registration

- Competitive Disadvantage: VAT-registered businesses must charge 20% more than non-registered competitors

- Customer Impact: B2C businesses face immediate 20% price disadvantage in competitive markets

- Administrative Burden: VAT registration brings quarterly returns and complex record-keeping requirements

- Cash Flow Shock: Businesses must collect and hold VAT payments for HMRC, reducing working capital

- Growth Suppression: Many businesses deliberately limit growth to stay below the threshold

Compliance and Administrative Costs

Making Tax Digital and other compliance requirements create crushing administrative burdens:

- Digital Reporting: Mandatory quarterly digital submissions for VAT and increasingly other taxes

- Software Costs: Businesses must purchase approved accounting software, typically £50-300 monthly

- Professional Fees: Many small businesses require accountants for compliance, costing £2,000-8,000 annually

- Time Investment: Business owners spending 8-15 hours monthly on tax compliance instead of growing their business

- Penalty Risks: Harsh fines for late submissions or errors, even when unintentional

- Record Keeping: Extensive documentation requirements creating storage and organization costs

The tax cliff edge: How cumulative tax burdens spike dramatically at growth thresholds, often exceeding the marginal revenue that triggered them.

The Cycle of Failure

Around 20% of UK businesses fail in their first year, rising to 60% within five years according to ONS data. While multiple factors contribute to these failures including market demand, management challenges, and financing difficulties tax cliff edges often play a decisive role in tipping struggling businesses into collapse. Understanding this cycle reveals how structural tax design problems contribute to business failure patterns across thousands of enterprises annually.

Year One: The Honeymoon Period

Many new businesses begin with optimism and minimal tax burden:

- Below Thresholds: Revenue typically under £90,000, avoiding VAT registration

- Minimal Employment: Founders work unpaid or below NICs thresholds

- Loss Relief: Early losses reduce corporation tax liability

- Focus on Growth: All energy directed toward customer acquisition and service development

- Competitive Pricing: No VAT allows aggressive pricing to build market share

- Cash Flow Flexibility: Revenue retained for working capital and investment

Growth Phase: Approaching the Cliff Edge

As businesses gain traction, they approach the dangerous threshold zones:

- Revenue Growth: Monthly turnover climbing toward £7,500+ (£90,000 annually)

- Staff Expansion: Need to hire first employees to manage increased demand

- Investment Requirements: Equipment, inventory, and marketing costs rising with scale

- Margin Pressure: Competition preventing price increases despite rising costs

- Customer Expectations: Established service levels creating operational constraints

- Cash Flow Tightening: Growth requiring working capital investment before revenue stabilizes

The Tax Cliff Edge Impact

Success triggers immediate and often dramatic cost increases that many small businesses struggle to absorb:

- VAT Registration: Must charge VAT on sales, creating competitive disadvantage against non-VAT competitors

- NICs Liability: Employee hiring triggers 13.8% additional cost on all salaries above £9,100

- Corporation Tax: Profits that were previously tax-free now face 19-25% taxation

- Compliance Burden: Administrative requirements jump from minimal to 10-15 hours monthly

- Professional Costs: Many businesses need accountants and tax advisors, typically costing £1,000-5,000 annually

- Systems Investment: Accounting software and record-keeping systems required immediately

Cash Flow Crunch

The timing mismatch between tax obligations and business stability creates severe pressure that contributes to many business failures:

- Immediate Costs: Tax and compliance obligations due immediately upon threshold crossing

- Revenue Lag: Customer base and revenue streams often still stabilizing during growth phase

- Working Capital Drain: VAT collections and tax provisions reduce available cash

- Competitive Pressure: Price increases due to VAT may drive customers to non-VAT competitors

- Investment Diversion: Money needed for growth diverted to tax compliance and payments

- Management Distraction: Founder focus shifts from business development to tax survival

Business Failure Factors

While not all businesses facing tax cliff edges fail, the additional financial and operational pressure contributes to collapse patterns observed across many small enterprises:

- Customer Loss: Price increases may drive customers to competitors, reducing revenue

- Cash Flow Crisis: Difficulty meeting both tax obligations and operational costs

- Credit Deterioration: Late tax payments can affect credit ratings and supplier relationships

- Founder Stress: Financial pressure and overwork affecting decision-making capacity

- Investment Exhaustion: Personal and family savings depleted by compliance costs and tax payments

- Premature Closure: Business closes before reaching the scale needed to absorb tax costs efficiently

Sector Specific Impact Analysis

The tax cliff edge affects different sectors in distinct ways, but the pattern of growth, punishment remains consistent across industries.

Retail: The VAT Competitiveness Killer

Independent retail faces the harshest impact from VAT threshold crossing:

- Price Sensitivity: Consumers highly sensitive to 20% price increases on discretionary purchases

- Online Competition: Competing against international sellers who may not charge UK VAT

- Local Competition: Directly competing against other independent retailers below VAT threshold

- Margin Pressure: Unable to absorb VAT costs due to already thin retail margins

- Customer Communication: Difficulty explaining sudden price increases to established customer base

- Inventory Challenges: VAT adds complexity to pricing and stock management

Hospitality: Employment Tax Burden

Restaurants, cafes, and pubs face particular pressure from employment tax:

- Labor Intensive: High employee numbers magnify NICs impact significantly

- Seasonal Variation: VAT registration triggered by peak season trading

- Tip Complications: Service charges and tips adding VAT complexity

- Food vs. Service: Mixed VAT rates creating administrative complications

- Alcohol Duties: Multiple tax layers on licensed premises

- Delivery Services: Online ordering platforms adding compliance complexity

Manufacturing: Energy and Employment Costs

Small manufacturers face a triple hit from taxation, energy costs, and compliance:

- Equipment Investment: High capital costs but immediate tax obligations on profits

- B2B VAT: While B2B customers can reclaim VAT, pricing becomes more complex

- Export Complications: Zero-rated exports requiring complex VAT accounting

- Supply Chain VAT: Managing VAT across complex supplier relationships

- Inventory Valuation: VAT affecting stock valuation and working capital calculations

- Quality Compliance: Additional regulatory compliance costs alongside tax burden

Digital Services: The Modern Cliff Edge

Digital businesses face unique tax complications that can kill growth momentum:

- Global Customers: Complex VAT rules for international digital services

- Platform Integration: Payment processor and platform fees compounding tax costs

- Subscription Models: Recurring billing complications with VAT registration

- Software Costs: VAT-compliant accounting software essential from day one of registration

- Digital Services Tax: Additional 2% levy on digital platform revenues above £25m

- MOSS Complications: EU VAT mini one-stop shop rules for international sales

The International Perspective

Other countries demonstrate that supportive tax policy for small businesses can foster entrepreneurship rather than destroying it.

Germany: The Existenzgründer Model

Germany provides various forms of support for new business formation:

- Kleinunternehmerregelung: Simplified VAT exemption for businesses under €22,000 (approximately £19,000)

- Gradual Thresholds: Some tax obligations increase more gradually than the UK's cliff-edge approach

- Regional Support: Various regional and federal grant programs for new business formation

- Social Security Adjustments: Some reduced social security contributions available for new entrepreneurs

- Business Advisory Services: Publicly funded business advice and mentoring programs

- Streamlined Procedures: Generally simplified paperwork for small business registration

Estonia: Digital-First Approach

Estonia's e-Residency program demonstrates how digital systems can simplify business administration:

- Retained Earnings Exemption: No corporation tax on retained and reinvested company earnings

- Digital Administration: Most tax compliance can be handled through digital interfaces

- Simplified Options: Flat-rate tax schemes available for qualifying small businesses

- Reduced Administrative Burden: Generally lower compliance requirements for small enterprises

- Transparent Framework: Clear, predictable tax obligations published online

- Growth-Oriented Design: Tax structure generally supports rather than penalizes business reinvestment

Ireland: Lower Corporate Taxation

Ireland's approach demonstrates how competitive tax rates can support business development:

- Lower Corporate Rate: 12.5% corporation tax rate compared to UK's 25%

- R&D Tax Credits: Enhanced credits for research and development activities

- Employment Incentives: Various schemes supporting job creation

- Business-Friendly Registration: Generally streamlined business setup processes

- Pro-Business Environment: Policy framework designed to attract business investment

- Stable Tax Environment: Predictable tax rates allowing for business planning

Reform Strategies: Breaking the Cliff Edge

The UK could improve its startup success rate through targeted tax reforms that better support business growth during critical early phases.

Starter Rate Corporation Tax

A reduced corporation tax rate for new businesses could provide crucial breathing room:

Proposed Starter Rate Framework

- Rate Structure: 10% on first £50,000 profit, 15% on £50,000-£100,000

- Duration: Available for first 3 years of trading

- Eligibility: New companies with fewer than 10 employees

- Anti-Avoidance: Rules preventing established businesses from claiming startup status

- Growth Incentive: Reduces effective tax rate during crucial early growth phase

- Revenue Protection: Higher rates apply once businesses achieve scale

National Insurance Holiday

Eliminating the employment tax penalty could encourage job creation:

Employment Growth Support

- NICs Holiday: Waive employer National Insurance for first 24 months

- Job Creation Incentive: Encourage employment rather than penalizing it

- Apprenticeship Support: Extended holiday for businesses training apprentices

- Regional Variation: Longer holidays in areas with high unemployment

- Graduated Return: Phased reintroduction rather than cliff edge restart

- Youth Employment: Additional support for businesses employing under 25s

VAT Threshold Reform

The most critical reform needed is elimination of the VAT cliff edge:

VAT Competitiveness Protection

- Raised Threshold: Increase VAT registration threshold to £150,000

- Gradual Introduction: Phased VAT rates (5%, 10%, 15%, then 20%) based on turnover

- Voluntary Registration: Allow businesses to register early if beneficial

- Simplified Accounting: Flat rate schemes available to all small businesses

- Sector Adjustments: Different thresholds for different types of business

- Annual Reviews: Regular adjustment of thresholds for inflation

Simplified Compliance

Reducing administrative burden could free up resources for business growth:

Small Business Administrative Relief

- Reduced Reporting: Annual instead of quarterly returns for businesses under £150,000

- Simplified Records: Basic record keeping requirements for micro-businesses

- Digital Support: Free government provided basic accounting software

- Professional Advice: Subsidized accountancy support for first time businesses

- Error Tolerance: Warning system instead of immediate penalties for minor mistakes

- Language Support: Multi-language guidance for diverse entrepreneurship

Energy Cost Relief

Extending industrial energy relief to small businesses could improve competitiveness:

Small Business Energy Support

- Energy Price Caps: Extended industrial energy caps to businesses under 50 employees

- Renewable Support: Grants for small business renewable energy installation

- Efficiency Programs: Subsidized energy audits and improvement programs

- Cooperative Purchasing: Government facilitated group purchasing for better energy rates

- Grid Connection Support: Reduced connection fees for small business renewable projects

- Peak Shaving: Battery storage grants to reduce peak demand charges

Economic Impact Analysis

Well designed tax reform supporting small businesses could create positive economic effects, though quantifying precise impacts requires careful analysis.

Potential Business Survival Improvements

Removing cliff edges could help improve business survival statistics:

- Survival Rate Analysis: International evidence suggests graduated tax systems may support better business survival rates

- Employment Effects: Businesses that survive longer typically create more employment opportunities over time

- Innovation Support: Businesses with better survival rates have more opportunity to develop and commercialize innovations

- Regional Benefits: Areas dependent on small business could particularly benefit from improved survival rates

- Sector Diversity: Better support could help maintain diverse business ecosystems

- Long-term Development: Businesses surviving initial phases can develop sustainable growth strategies

Tax Revenue Considerations

The relationship between tax rates and total revenue is complex, but some evidence suggests strategic rate reductions can increase overall collections:

- Volume Effects: More surviving businesses contribute to the tax base over longer periods

- Growth Acceleration: Businesses may reach higher tax brackets faster with appropriate support

- Employment Tax Generation: Job creation generates income tax and NICs revenue

- Consumer Spending: Employment growth can increase VAT revenue through consumer spending

- Business Rates: Successful businesses contribute to local taxation through property occupation

- Progressive Contribution: Businesses may eventually graduate to higher tax rates as they grow

Broader Economic Effects

Small business success can create wider economic benefits:

- Supply Chain Effects: Successful small businesses create demand for suppliers and services

- Innovation Environment: Diverse business ecosystems can foster competitive innovation

- Economic Resilience: Less economic dependence on large employers through business diversity

- Skills Development: Small businesses often provide apprenticeships and training opportunities

- Export Development: Some successful small businesses develop export capabilities over time

- Community Investment: Local businesses often reinvest in their immediate communities

Political and Economic Challenges

Implementing small business tax reform faces predictable resistance from entrenched interests and short-term thinking.

Treasury Revenue Concerns

The Treasury's focus on short term revenue extraction conflicts with long-term growth:

- Immediate Revenue Loss: Lower rates and higher thresholds reduce immediate tax receipts

- Modeling Challenges: Treasury models may struggle to quantify long term benefits of business survival

- Budget Pressure: Annual budget cycles prioritizing immediate revenue over growth

- Risk Aversion: Conservative Treasury culture resistant to experimental policies

- Complexity Resistance: Preference for simple collection over targeted support

Large Business Opposition

Established businesses may oppose support for their potential competitors:

- Competitive Advantage: Large businesses benefit from barriers that prevent small business growth

- Tax Complexity: Large businesses have resources to manage complex tax compliance

- Market Share Protection: Reduced competition from failed startups benefits incumbents

- Lobbying Power: Large businesses have more political influence than scattered small businesses

- Implementation Costs: Tax system changes require expensive adjustments to large business systems

Administrative Resistance

HMRC and government departments may resist reforms that complicate their operations:

- System Changes: Tax software and processing systems require expensive modification

- Training Requirements: Staff need retraining on new rules and procedures

- Fraud Concerns: More complex rules create additional opportunities for abuse

- Monitoring Challenges: Tracking business eligibility for various support measures

- Performance Metrics: HMRC targets focused on revenue collection rather than business support

International Competition

The UK's failure to support small businesses creates competitive disadvantages that affect the entire economy.

Brexit Complications

Leaving the EU has made small business support more critical, not less:

- Trade Barriers: Additional export complexity requiring stronger domestic businesses

- Regulatory Divergence: Opportunity to create more supportive business environment

- Global Competition: Need to attract international businesses and investment

- Supply Chain Resilience: Diverse domestic business base reducing import dependency

- Innovation Leadership: Small business innovation crucial for economic differentiation

Digital Economy Competition

The digital economy makes it easier for businesses to locate in supportive jurisdictions:

- Remote Operations: Digital businesses can easily relocate to tax friendly countries

- Talent Mobility: Entrepreneurs can start businesses in countries with better support

- Investment Flows: Venture capital flowing to ecosystems with supportive policy environments

- Platform Effects: Success breeds success as supportive jurisdictions attract more businesses

- Reputation Impact: Word spreads quickly about countries that support or hinder entrepreneurship

Conclusion: From Cliff Edge to Growth Ladder

Sarah's coffee shop didn't have to close. With the right tax policy, she could have grown into a successful business employing dozens of people, paying substantial taxes, and contributing to Manchester's economic vitality. Instead, the UK tax system's cliff edge design destroyed a viable business at the moment it showed promise, wasting investment, killing jobs, and reducing the tax base.

This story repeats thousands of times annually across Britain as the tax system systematically destroys entrepreneurial ambition. The VAT threshold cliff edge, employment tax penalties, and compliance burdens create a perfect storm that kills businesses just as they begin to succeed.

The human cost is enormous dreams destroyed, investments lost, families bankrupted by a tax system that punishes success and rewards failure. The economic cost is even larger: hundreds of thousands of jobs that never get created, innovations that never reach market, and tax revenue that never materializes because the businesses that would have paid it were killed before they could grow.

Other countries demonstrate that different approaches are possible. Estonia's zero corporate tax on retained earnings, Germany's gradual threshold system, and Ireland's startup-friendly rates show that supporting small businesses creates larger tax bases and more employment than extracting maximum revenue from struggling enterprises.

The reforms needed are not complex: starter rates for corporation tax, National Insurance holidays for job creation, VAT threshold increases with graduated introduction, and simplified compliance procedures. These changes would transform the UK from a country that accidentally destroys small businesses into one that actively supports entrepreneurship.

The economic benefits would be transformative. Higher business survival rates would create more employment, more innovation, more competition, and ultimately more tax revenue. The regions most dependent on small businesses would see economic revival as local entrepreneurs could finally build sustainable enterprises.

But the change requires political courage to prioritize long-term growth over short-term Treasury receipts. It means accepting that lower tax rates can generate higher tax revenue through business success, and that supporting entrepreneurship is an investment in national competitiveness.

The choice facing Britain is clear: continue with a tax system that creates difficulties for small businesses at critical growth phases, or implement reforms that better support the transition from startup to established enterprise. The difference between these approaches will significantly influence whether the UK develops a thriving entrepreneurial ecosystem or continues to see promising businesses struggle at key growth thresholds.

Part 3 of this series will tie the threads together, industry spiral and small business cliff edge into a broader reform narrative

Sarah's coffee shop represents thousands of similar businesses facing the same structural challenges. Whether future entrepreneurs succeed or struggle with these same obstacles depends on whether Britain chooses to reform its approach to supporting business growth during critical early phases.