The latest ONS figures tell a stark story: UK industrial output fell 0.5% in Q3 2025, with manufacturing down 0.8%. Transport equipment production dropped sharply, partly due to supply chain disruptions and cyber attacks. But these quarterly statistics mask a deeper structural crisis that threatens the very existence of British industry.

The UK is trapped in a vicious cycle where domestic costs spiral upward faster than productivity, making it cheaper for companies to manufacture abroad, ship goods to the UK, pay import duties, and still undercut local producers. This isn't just about global competition it's about policy choices that systematically undermine industrial competitiveness while enriching energy companies and the Treasury at the expense of productive economic activity.

🏭 The Industrial Death Spiral

- UK industrial output declining 0.5% quarterly while costs rise faster than productivity

- Energy profit margins far above global averages, inflating industrial production costs

- Wage cost price spiral benefits Treasury through higher tax receipts but destroys competitiveness

- Import manufacture export cycle now more profitable than domestic production

- Strategic industries hemorrhaging capacity to overseas competitors

- Policy framework inadvertently subsidizing deindustrialization

The Decline in UK Industry: Beyond the Statistics

While headlines focus on quarterly fluctuations, the real story is the systematic erosion of Britain's industrial base over decades a process that has accelerated dramatically in recent years as cost pressures intensify.

The Scale of Industrial Contraction

The numbers paint a picture of an economy in industrial retreat:

- Manufacturing Output: Down 0.8% in Q3 2025, continuing a trend of volatile but declining production

- Transport Equipment: Sharp drops due to supply chain vulnerabilities and cyber-security incidents

- Chemical Production: Falling competitiveness against European and Asian producers with lower energy costs

- Steel Industry: Operating at fraction of historical capacity, with multiple plant closures

- Electronics Manufacturing: Largely relocated to Asia, leaving UK as assembly and distribution hub

- Textile Industry: Virtually eliminated, unable to compete with low-cost overseas production

Structural vs Cyclical Factors

While some decline reflects global economic cycles, the underlying drivers are structural and policy driven:

- Energy Cost Differential: UK industrial energy prices significantly higher than EU and global competitors

- Labor Cost Inflation: Minimum wage rises outpacing productivity gains, increasing unit labor costs

- Tax Burden Distribution: Corporate taxes and National Insurance creating higher costs than competitor nations

- Regulatory Complexity: Compliance costs disproportionately affecting smaller manufacturers

- Infrastructure Deficits: Poor transport and digital infrastructure increasing logistics costs

- Skills Shortages: Lack of technical training creating productivity bottlenecks

The Global Competitiveness Context

UK industry faces a perfect storm of cost pressures that make overseas production increasingly attractive:

- Asian Manufacturing Hubs: Lower labor costs, government subsidies, and efficient supply chains

- European Competitors: State involvement in energy markets keeping industrial costs lower

- North American Advantages: Cheap energy from domestic fossil fuel production and renewable expansion

- Trade Route Efficiency: Shipping costs often lower than domestic production cost differentials

- Currency Factors: Sterling strength making UK exports expensive while imports remain cheap

The Lifecycle of Spiralling Costs

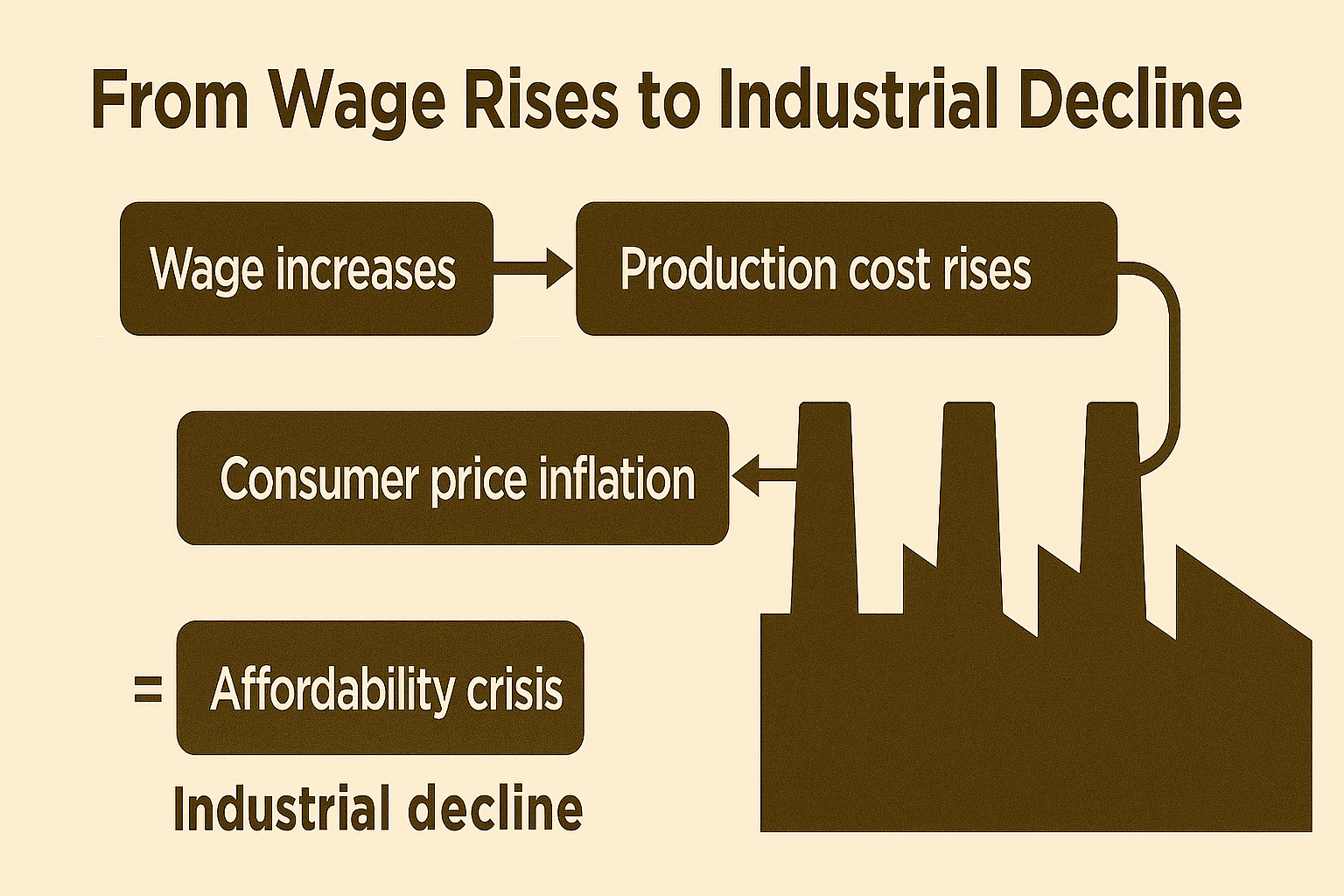

At the heart of Britain's industrial decline lies a vicious cycle that policymakers seem unable to escape. Each attempt to address cost-of-living pressures through wage increases creates new cost pressures that ultimately undermine the very industries that could provide sustainable employment.

Stage 1: The Wage Response

When cost-of-living pressures mount, the political response is predictable:

- Minimum Wage Increases: Government raises minimum wage to help households cope with inflation

- Public Sector Pay Rises: Civil service, NHS, and education workers receive above-inflation increases

- Private Sector Pressure: Tight labor market forces companies to match public sector increases

- Short-term Relief: Households gain immediate spending power, providing temporary political benefit

- Consumer Demand: Higher wages boost consumption, creating appearance of economic success

Stage 2: Production Cost Inflation

Wage increases rapidly translate into higher production costs across the economy:

- Direct Labor Costs: Manufacturing wages rise, increasing unit production costs

- Service Sector Spillover: Higher wages in logistics, maintenance, and support services

- Supply Chain Transmission: Cost increases spread through interconnected supplier networks

- Energy Sector Impact: Higher operational costs for power generation and distribution

- Transport Cost Rises: Increased wages for drivers, logistics workers, and port operations

Stage 3: Price Transmission to Consumers

Companies have little choice but to pass cost increases to consumers:

- Shelf Price Inflation: Retail prices rise to maintain business viability

- Service Cost Increases: Everything from haircuts to home repairs becomes more expensive

- Housing Cost Pressure: Rental prices rise as landlord costs increase

- Utility Bill Growth: Energy and water companies pass through higher operational costs

- Transport Fare Increases: Public and private transport costs rise across the board

Stage 4: The Affordability Crisis Returns

Within 12-18 months, wage gains are eroded by price increases:

- Real Income Decline: Purchasing power falls as prices rise faster than wages

- Political Pressure Mounts: Voters demand action on cost-of-living crisis

- Social Unrest Risk: Industrial action and public protests over affordability

- Electoral Consequences: Government popularity falls as household budgets tighten

- Policy Panic: Desperate search for quick fixes to restore affordability

Stage 5: The Cycle Repeats

Unable to break the underlying pattern, policymakers resort to the same failed approach:

- Another Wage Rise: Government announces new minimum wage increases

- Temporary Relief: Short-term political benefit from appearing to help workers

- Cost Spiral Accelerates: Each cycle creates higher baseline costs

- Industrial Decline Deepens: Manufacturers increasingly unable to compete

- Import Dependency Grows: Domestic production replaced by overseas manufacturing

The vicious cycle: Wage increases → Production cost rises → Consumer price inflation → Affordability crisis → More wage increases → Industrial decline

The Treasury Benefit Problem

This cycle persists partly because it benefits the government financially:

- Higher Tax Receipts: Increased wages generate more income tax and National Insurance

- VAT Revenue Growth: Higher prices mean more VAT on consumer spending

- Corporation Tax Gains: Profitable service sectors generate more corporate tax

- Reduced Benefit Spending: Fewer people eligible for in-work benefits

- Short-term Budget Relief: Treasury benefits mask long-term economic damage

Energy Profits vs Industrial Decline

One of the most damaging aspects of the UK's cost spiral is the energy sector's excessive profiteering, which directly undermines industrial competitiveness while enriching shareholders at the expense of productive economic activity.

The Scale of Energy Sector Profiteering

UK energy companies enjoy profit margins far above global averages:

- Electricity Generation: Profit margins of 15-25% compared to 8-12% in France and Germany

- Gas Supply: Retail margins 20-30% above European competitors

- Distribution Networks: Regulated returns often exceeding reasonable infrastructure investment rates

- Trading Operations: Energy trading generating enormous profits from price volatility

- Renewable Subsidies: Windfall profits from subsidy schemes designed for different market conditions

Industrial Cost Impact

Excessive energy profits translate directly into industrial uncompetitiveness:

- Manufacturing Energy Bills: Industrial electricity costs 40-60% higher than main EU competitors

- Chemical Industry: Energy-intensive processes becoming unviable due to high input costs

- Steel Production: Electric arc furnaces uncompetitive against countries with cheaper power

- Aluminum Smelting: Industry virtually eliminated due to energy cost disadvantage

- Data Centers: Digital infrastructure relocating to countries with affordable power

- Food Processing: Refrigeration and processing costs making UK production uncompetitive

International Comparisons

Other countries demonstrate that affordable industrial energy is achievable through different policy approaches:

- France: State involvement in energy markets keeping industrial electricity costs 30% below UK levels

- Germany: Industrial energy discounts and long-term contracts protecting manufacturing

- Netherlands: Gas hub providing competitive pricing for energy-intensive industries

- Norway: Hydroelectric abundance creating industrial competitive advantage

- United States: Shale gas revolution providing cheap energy for manufacturing renaissance

The Profit Cap Solution

A targeted approach to energy sector profit regulation could restore industrial competitiveness:

Essential Service Profit Cap Framework

Core Principle: Cap profits on essential services at 10% above wholesale costs

- Scope: Electricity generation, gas supply, water services, and essential transport

- Calculation Method: 10% margin on verifiable wholesale input costs

- Investment Protection: Additional returns allowed for genuine infrastructure investment

- Innovation Incentives: Efficiency gains can be retained for 5 year periods

- Regional Variation: Different caps for different cost environments

- Transparency Requirements: Public reporting of cost structures and profit calculations

Benefits of Profit Cap Implementation

Capping essential service profits would provide multiple economic benefits:

- Industrial Competitiveness: Lower energy costs making UK manufacturing viable again

- Household Relief: Reduced energy bills improving living standards

- Investment Redirection: Capital flowing from speculation to productive investment

- Inflation Reduction: Lower energy costs reducing general price pressures

- Employment Creation: Viable industries creating sustainable employment

- Trade Balance: Import substitution improving current account position

French Model Success

France's approach to energy markets demonstrates the effectiveness of state involvement:

- EDF Structure: Majority state ownership ensuring public interest prioritization

- Regulated Pricing: Government involvement in price setting protecting consumers and industry

- Nuclear Strategy: Long-term energy planning reducing dependence on volatile gas markets

- Industrial Support: Energy policy explicitly designed to support manufacturing competitiveness

- Regional Development: Energy infrastructure supporting balanced economic development

The Competitiveness Death Spiral

The interaction between wage inflation, energy profiteering, and tax policy creates a self-reinforcing cycle of industrial decline that becomes harder to reverse with each iteration.

Manufacturing Margin Compression

UK manufacturers face a perfect storm of rising costs and limited pricing power:

- Input Cost Inflation: Raw materials, energy, and labor costs rising faster than productivity

- Global Price Competition: Unable to raise prices due to cheaper imports

- Margin Squeeze: Profits disappearing as costs rise but revenues stagnate

- Investment Withdrawal: Companies stopping capital investment to maintain short-term viability

- Closure Decisions: Plants becoming uneconomic and shutting down permanently

The Import Substitution Accelerator

As domestic production becomes uncompetitive, import dependency accelerates:

- Retail Procurement: Supermarkets and retailers switching to overseas suppliers

- Business-to-Business: UK companies sourcing inputs from abroad rather than domestically

- Construction Materials: Building industry importing rather than using UK production

- Consumer Goods: Household items increasingly manufactured overseas

- Industrial Components: Manufacturing supply chains relocating outside the UK

Skills and Capability Loss

Industrial decline creates long-term capability destruction:

- Technical Skills Exodus: Experienced workers leaving for other sectors or emigrating

- Training System Collapse: Apprenticeship programs closing as companies shut down

- Innovation Decline: R&D investment falling as industrial base shrinks

- Supply Chain Disruption: Specialist suppliers closing, affecting remaining producers

- Knowledge Transfer Breakdown: Industrial expertise lost as older workers retire

Regional Economic Impact

Industrial decline creates devastating regional consequences:

- Industrial Town Decay: Communities built around manufacturing facing economic collapse

- Unemployment Concentration: Job losses concentrated in areas with limited alternative employment

- Property Value Decline: Industrial area house prices falling as jobs disappear

- Service Sector Impact: Local businesses closing as industrial workers lose income

- Brain Drain: Young people leaving industrial regions for service sector opportunities

The False Economy of Offshoring

While individual companies may benefit from moving production overseas, the collective impact on the UK economy reveals the false nature of these apparent savings.

The Offshoring Calculation

Companies increasingly find overseas production more profitable than UK manufacturing:

- Labor Cost Arbitrage: Wages 50-80% lower in developing countries

- Energy Cost Advantages: Industrial electricity often 40-60% cheaper overseas

- Regulatory Savings: Lower compliance costs in countries with less stringent regulations

- Tax Optimization: Transfer pricing and jurisdiction shopping reducing effective tax rates

- Shipping Economics: Container transport costs often lower than domestic cost differentials

Hidden Costs of Import Dependency

The true cost of offshoring extends far beyond company balance sheets:

- Supply Chain Vulnerability: Pandemic and geopolitical disruptions exposing import dependence risks

- Currency Exposure: Sterling weakness making imports more expensive

- Quality Control Issues: Distance making quality assurance more difficult and expensive

- Innovation Loss: R&D and product development moving offshore with production

- Lead Time Problems: Longer supply chains reducing responsiveness to market changes

Macroeconomic Consequences

Individual company decisions create collective economic damage:

- Trade Deficit Expansion: Import growth without corresponding export development

- Employment Hollowing: Manufacturing jobs disappearing faster than service sector can absorb workers

- Tax Base Erosion: Corporate tax revenue falling as production moves overseas

- Regional Inequality: Industrial regions declining while service centers prosper

- Strategic Vulnerability: Critical supply chains dependent on potentially hostile nations

Policy Failures and Misaligned Incentives

The UK's industrial decline is not an inevitable result of global competition but a direct consequence of policy choices that systematically favor consumption over production and services over manufacturing.

Tax Policy Bias Against Production

The UK tax system inadvertently punishes productive investment:

- Corporation Tax Structure: Higher effective rates on manufacturing than on financial services

- National Insurance Burden: Employment taxes making labor-intensive production uncompetitive

- Capital Allowances: Depreciation rules favoring property investment over industrial equipment

- R&D Credits: Innovation tax relief often captured by service sector rather than manufacturing

- Business Rates: Property taxes hitting manufacturing facilities harder than office-based businesses

Energy Policy Contradictions

Climate policy inadvertently undermines industrial competitiveness:

- Carbon Tax Asymmetry: UK production taxed for emissions while imports face no equivalent charges

- Renewable Subsidy Costs: Industrial users paying for green transition through higher bills

- Grid Investment Delays: Infrastructure bottlenecks constraining industrial expansion

- Gas Dependence: Continued reliance on volatile gas markets despite renewable investment

- Nuclear Delays: Slow progress on low-carbon baseload power increasing energy costs

Skills Policy Mismatch

Education and training policy fails to support industrial needs:

- University Bias: Education funding favoring academic over technical qualifications

- Apprenticeship Decline: Manufacturing apprenticeships falling as industry shrinks

- Immigration Policy: Skills visas designed for services rather than manufacturing needs

- Regional Inequality: Training investment concentrated in service sector centers

- Technical Education: Further education colleges underfunded compared to universities

Regional Policy Neglect

Government policy inadvertently accelerates regional industrial decline:

- Transport Investment: Infrastructure spending favoring London and service centers

- Innovation Hubs: R&D investment concentrated in university towns rather than industrial areas

- Planning Bias: Development rules favoring housing and retail over industrial use

- Financial Services Focus: Economic development priorities centered on London's needs

- Leveling Up Failure: Regional development programs failing to address industrial competitiveness

International Models of Industrial Success

Other developed countries demonstrate that industrial competitiveness is achievable through different policy approaches that prioritize productive investment and manufacturing competitiveness.

Germany: The Mittelstand Model

Germany maintains industrial competitiveness through systematic policy support:

- Industrial Energy Discounts: Reduced electricity costs for energy intensive manufacturing

- Technical Education: Dual education system producing skilled industrial workers

- Regional Balance: Manufacturing distributed across regions rather than concentrated

- Long-term Finance: Banking system oriented toward industrial investment rather than speculation

- Export Orientation: Trade policy supporting manufacturing exports

South Korea: Strategic Industrial Policy

South Korea's transformation from agricultural to industrial economy offers policy lessons:

- Sectoral Priorities: Government identification and support of strategic industries

- Technology Transfer: Active policies to acquire and develop industrial capabilities

- Infrastructure Investment: Massive public investment in industrial infrastructure

- Education Alignment: Technical education closely aligned with industrial needs

- Export Promotion: Government support for industrial export development

United States: Energy Advantage

America's manufacturing renaissance demonstrates the power of energy cost advantages:

- Shale Gas Revolution: Cheap natural gas providing industrial competitive advantage

- Reshoring Incentives: Tax policies encouraging return of overseas production

- Infrastructure Investment: Federal programs supporting industrial infrastructure

- Buy America Policies: Government procurement supporting domestic production

- Technology Leadership: Innovation policies maintaining industrial technological edge

The Path Forward: Preview of Solutions

Breaking the UK's industrial death spiral requires comprehensive policy reform that addresses energy costs, tax structures, and the fundamental incentives driving economic decision making.

Essential Service Reform

Profit caps on energy, water, and transport could restore industrial competitiveness:

- 10% Profit Cap: Maximum 10% margin above wholesale costs for essential services

- Industrial Tariffs: Special electricity and gas rates for manufacturing

- Long-term Contracts: Price stability for industrial users through multi year agreements

- Public Ownership Options: Strategic assets returned to public control where appropriate

- Windfall Taxation: Excess profits redirected to industrial development funds

Tax System Rebalancing

Shifting the tax burden away from productive investment toward speculation and consumption:

- Manufacturing Tax Relief: Reduced Corporation Tax rates for industrial production

- Employment Tax Reduction: Lower National Insurance for manufacturing employment

- Capital Allowances: Accelerated depreciation for industrial equipment

- Speculation Taxes: Higher rates on financial speculation and property speculation

- Carbon Border Adjustment: Import taxes to level the playing field with carbon intensive imports

Reshoring and Industrial Development

Active policies to encourage the return of manufacturing to the UK:

- Reshoring Grants: Direct financial support for companies bringing production back to the UK

- Strategic Industries: Targeted support for automotive, semiconductors, and green technology

- Supply Chain Development: Programs to rebuild UK supply chains in critical sectors

- Innovation Clusters: Regional centers linking research institutions with manufacturing

- Skills Development: Massive expansion of technical education and apprenticeships

🔧 Coming in Parts 2 & 3

- Part 2: Detailed policy solutions including specific tax reforms, energy market restructuring, and reshoring incentive programs

- Part 3: Implementation strategies, political challenges, and how citizens can advocate for industrial policy reform

Conclusion: The Choice Facing Britain

The UK stands at a crossroads. The current trajectory leads to complete deindustrialization a future where Britain becomes entirely dependent on imports for manufactured goods while relying on an increasingly fragile service sector for employment and economic growth. The quarterly statistics showing industrial decline are not just numbers; they represent the systematic destruction of the productive capacity that underlies long-term economic prosperity.

The wage cost price spiral (minimal wage increases) that dominates British economic policy may provide short-term political relief and Treasury revenue, but it systematically undermines the competitiveness of productive industry. Each round of wage increases designed to address cost-of-living pressures creates new cost pressures that make domestic manufacturing less viable. The beneficiaries are energy companies extracting excessive profits, the Treasury collecting higher taxes, and overseas manufacturers gaining market share at the expense of British production.

Energy sector profiteering plays a particularly destructive role, with UK industrial electricity and gas costs far above international competitors. The 15-25% profit margins enjoyed by UK energy companies compared to 8-12% in France and Germany directly translate into industrial uncompetitiveness. Chemical plants, steel mills, aluminum smelters, and data centers find themselves unable to compete with overseas facilities enjoying cheaper power.

The false economy of offshoring may benefit individual company balance sheets, but it creates collective economic damage through trade deficits, employment hollowing, tax base erosion, and strategic vulnerability. When companies find it cheaper to manufacture abroad, ship to the UK, pay import duties, and still undercut domestic production, something is fundamentally wrong with the UK's cost structure.

This is not an inevitable result of global competition or technological change. Other developed countries like Germany with its Mittelstand model, South Korea with strategic industrial policy, the United States with its energy advantages demonstrate that industrial competitiveness is achievable through different policy choices. France's approach to energy markets, with state involvement keeping industrial costs competitive, shows that profit cap policies can work without destroying investment incentives.

The solution requires breaking the cycle through comprehensive reform: profit caps on essential services to restore energy competitiveness, tax system rebalancing to support production over speculation, and active industrial policy to encourage reshoring and capability development. The 10% profit cap framework for energy, water, and transport would provide immediate relief to industry while still allowing healthy returns for genuine investment.

The choice is stark. Continue with policies that prioritize short-term political relief through wage increases and Treasury revenue through cost spirals, or implement the structural reforms necessary to rebuild a competitive industrial base. The current approach benefits energy companies, helps government finances, and provides temporary household relief, but it systematically destroys the productive foundations of long-term economic prosperity.

Parts 2 and 3 of this series will detail the specific policy solutions and implementation strategies necessary to reverse Britain's industrial decline. The diagnosis is clear: the UK is being taxed and regulated out of industrial existence. The question is whether the political system has the courage to implement the reforms necessary to reverse this destructive spiral before it becomes irreversible.

British industry is not doomed to decline. With smarter policy that prioritizes productive investment over speculation, energy affordability over excessive profits, and manufacturing competitiveness over short-term political fixes, the UK could rebuild a thriving industrial base. The technology exists, the workers can be trained, and the market opportunities are there. What's missing is the political will to prioritize long-term industrial competitiveness over short-term political and financial gains.

The time for action is now, before the remaining industrial capacity disappears entirely and the capability to rebuild becomes impossible. The quarterly statistics are a warning: act now, or watch British industry disappear forever.