London, November 2025 — The British Business Bank has published its Five Year Strategic Plan (2025-2030), outlining how it will support smaller businesses across the UK through targeted financing programs and market development initiatives. The plan focuses on addressing persistent gaps in access to finance while supporting the government's growth and levelling up objectives.

The strategy builds on the Bank's existing role as the UK's economic development bank, emphasizing patient capital deployment and market making activities to support businesses that struggle to access traditional commercial finance.

🔑 Strategic Priorities

- Patient Capital: Focus on long term financing solutions for businesses with growth potential

- Market Development: Building sustainable financing markets where gaps currently exist

- Regional Impact: Supporting economic development across all UK regions

- Innovation Support: Backing high potential businesses in emerging sectors

- Financial Inclusion: Improving access to finance for underserved communities and demographics

The Bank's Established Role

The British Business Bank, established in 2014, serves as the UK's economic development bank with a mandate to improve access to finance for smaller businesses. The new strategic plan builds on nearly a decade of operations, during which the Bank has:

- Supported over 100,000 smaller businesses

- Mobilized billions in additional private sector investment

- Developed new financing markets across equity, debt, and guarantee products

- Expanded access to finance in underserved regions

Supporting Manufacturing: Electricity Bill Relief

Alongside the strategic plan, the government has announced targeted support for manufacturing businesses struggling with energy costs. The Energy and Trade Intensive Industries (ETII) scheme will reduce electricity bills by up to 25% for eligible manufacturers.

Energy Cost Support Details

- Coverage: Around 300 manufacturing sites across England, Scotland, and Wales

- Savings: Up to 25% reduction in electricity bills for eligible businesses

- Duration: Support running through 2025

- Eligibility: Energy and trade intensive manufacturers meeting specific criteria

- Job Protection: Aimed at maintaining manufacturing employment and competitiveness

Manufacturing Sector Challenges

The electricity bill support addresses longstanding competitiveness issues in UK manufacturing:

- Energy Costs: UK manufacturers face some of the highest industrial electricity prices in Europe

- International Competition: Competitors in other countries benefit from lower energy costs

- Investment Decisions: High energy costs deterring new manufacturing investment

- Employment Impact: Job losses in energy-intensive industries

- Supply Chain Effects: Reduced UK manufacturing affecting broader industrial base

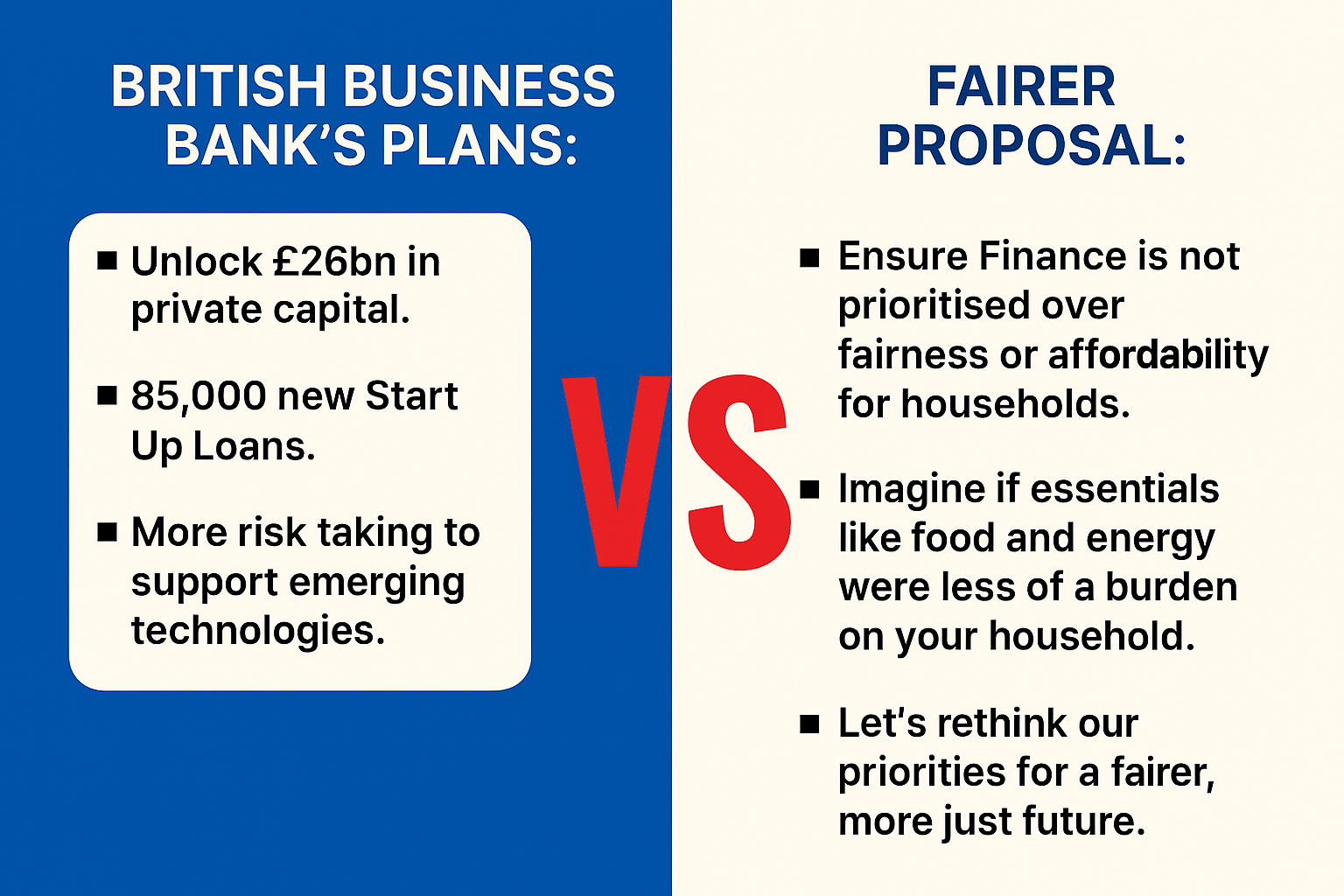

🗣️ The Debate: Is Finance Enough?

While the Bank's plan focuses on unlocking capital for businesses, reform advocates argue that finance alone cannot guarantee fairness or affordability for households.

At UKPoliticsDecoded.uk, proposals have been set out to limit profit margins on essential goods and services from food to energy this ensuring that public benefit is felt directly at the checkout and in household bills.

💡 Why Essential Goods Profit Limits Could Be More Effective

- Direct consumer impact: Unlike capital injections that may take years to filter through, profit limits on essentials would lower costs immediately

- Fairness narrative: Relief would be seen as serving the public first, not just investors or scale ups

- Inflation control: Targeting essentials could dampen price rises where families feel them most

- Household savings: Would deliver average household savings of £3,693 per year equivalent to a £308 monthly pay rise with even greater relief for pensioners, families, and disabled households.

- Stimulate the economy: Disposable income increase by £99 billion annually, stimulate £165.3 billion in economic activity.

- Increased Government revenue: The government would also benefit from a £35.3 billion net fiscal gain through reduced welfare spending, increased tax revenues, and lower healthcare costs.

📍 Read the full proposal: Limiting Profit on Essential Goods and Services

Integrated Economic Strategy

A comprehensive approach could combine business support with direct consumer protection:

- Business Investment: Supporting innovation, productivity, and job creation through financing

- Consumer Protection: Ensuring business growth translates into lower costs for essential goods

- Regional Development: Business support complemented by affordable living costs

- Sectoral Balance: Supporting both business competitiveness and household purchasing power

- Long-term Sustainability: Building a more balanced and equitable economic model

The British Business Bank's approach addresses genuine market failures in business finance, while manufacturing support tackles real competitiveness challenges. However, ensuring these benefits reach ordinary households may require additional measures targeting the cost of essential goods and services.

Read the full proposal: Limiting Profit on Essential Goods and Services

Conclusion: Targeted Support in Challenging Times

The British Business Bank’s strategic plan and the government’s energy relief for manufacturers both tackle urgent economic pressures, financing gaps and industrial competitiveness. These supply side interventions may strengthen business resilience and drive long-term growth, but their impact on household affordability remains limited.

To build a fairer economy, future policy must balance business support with direct consumer protection. Proposals like limiting profit margins on essential goods and services offer a clearer path to immediate relief for families, while still supporting critical supply chains.